Affordable Guide to Wedding Budget Management for Stress Free Planning

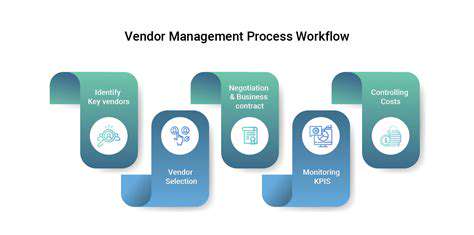

Negotiating with Vendors: Saving Money Without Sacrificing Quality

Understanding Your Needs

Before entering negotiations, it's essential to have a laser-focused grasp of what your company truly requires. What specific products or services are non-negotiable? Where does your budget have flexibility? Conducting comprehensive research and creating detailed specifications forms the backbone of successful vendor discussions. This preparation transforms vague ideas into concrete requirements, enabling you to spot cost-saving opportunities while maintaining your quality standards.

Researching Potential Vendors

Vendor selection shouldn't be rushed. Dedicate time to comparing multiple providers across pricing structures, service packages, and industry reputation. Dig beyond surface-level information by examining client testimonials, case studies, and third-party reviews. This investigative work reveals which vendors consistently deliver quality and helps you identify negotiation leverage points in their pricing models.

Developing a Negotiation Strategy

Successful negotiations require careful planning. List your must-haves versus nice-to-haves, establish clear boundaries for pricing and service levels, and determine your absolute walk-away point. This strategic framework prevents emotional decision-making during high-pressure discussions and keeps you focused on achieving optimal outcomes.

Crafting Your Initial Offer

Your opening proposal should reflect market realities while protecting your interests. Ground your numbers in research, and be ready to explain how this partnership benefits the vendor long-term. Professionalism matters - even firm negotiations should maintain mutual respect. The art lies in balancing assertiveness with collaboration to set the right tone for discussions.

Identifying Potential Savings

Creative problem-solving often reveals hidden cost reductions. Explore options like off-peak scheduling, bundled services, or alternative materials that maintain quality while lowering expenses. The best savings frequently come from reimagining standard approaches rather than simply demanding price cuts.

Handling Counteroffers and Negotiations

Expect give-and-take during negotiations. Listen actively to vendor concerns and look for solutions that satisfy both parties. Maintaining professionalism through disagreements builds trust that pays dividends later. View negotiations as relationship-building exercises rather than zero-sum competitions.

Evaluating the Final Agreement

Scrutinize every contract detail before signing. Verify that pricing, deliverables, timelines, and quality standards match your discussions. Written agreements prevent costly misunderstandings and protect both parties' interests throughout your business relationship.

Emotional intelligence serves as the invisible architecture of human connection. When we cultivate the ability to recognize and articulate emotions—both our own and others'—we acquire powerful tools for social navigation. This competency forms the foundation of all meaningful human relationships. It extends far beyond basic emotion recognition to encompass nuanced understanding of emotional undercurrents and their behavioral impacts.

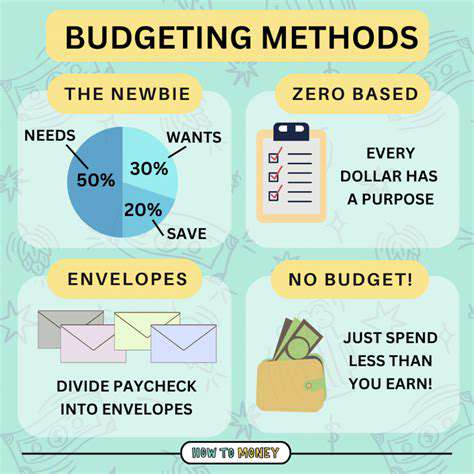

Tracking Your Spending and Staying on Track

Understanding Your Spending Habits

Examining expenditure patterns provides the foundation for sound financial management. Documenting every financial outlay—from routine purchases to major investments—creates a revealing map of your monetary flow. This visibility exposes spending leaks that quietly drain resources. Regular spending analysis transforms vague financial anxiety into actionable insights.

Detailed spending records illuminate wasteful expenditures you might otherwise overlook. Such awareness sparks behavioral changes that compound into significant savings over time, creating pathways to financial goals that once seemed unattainable.

Categorizing Expenditures

Organizing expenses into logical groupings (housing, transportation, leisure, etc.) creates a diagnostic tool for your financial health. This structure highlights spending imbalances and reveals opportunities for reallocation. Categorization turns chaotic spending data into an actionable financial blueprint, making it easier to align outflows with priorities.

Utilizing Budgeting Tools

Modern budgeting applications provide powerful assistance in financial tracking. These digital tools automate expense logging, generate visual spending reports, and send alerts when you approach budget limits. Technology removes the tedium from financial tracking, making consistent monitoring achievable rather than aspirational.

Setting Realistic Financial Goals

Well-defined financial targets (like saving for a home or eliminating credit card debt) create motivation for disciplined spending. Goals transform abstract financial responsibility into concrete milestones. Breaking large objectives into smaller, time-bound steps maintains momentum through quick wins.

Monitoring and Adjusting Your Budget

Financial plans require regular review to remain effective. Periodic check-ins allow for course corrections before small deviations become major problems. This proactive approach prevents financial surprises and builds confidence in your money management skills.

The Importance of Regular Review

Scheduled financial audits (monthly or quarterly) create accountability and highlight progress. These checkpoints transform money management from reactive to strategic, allowing celebration of successes and timely correction of missteps. Consistent review builds financial resilience against life's uncertainties.

Read more about Affordable Guide to Wedding Budget Management for Stress Free Planning

Hot Recommendations

- Step by Step Guide to Creating a Memorable Wedding Experience

- Expert Advice on Planning a Wedding with Family Traditions

- How to Organize a Destination Wedding That Reflects Your Style

- How to Choose the Perfect Wedding Venue for Your Style

- Expert Tips for Choosing Wedding Decor That Elevates Your Event

- How to Plan a Timeless Wedding with Modern Flair

- How to Create a Detailed Wedding Plan That Covers Every Detail

- How to Choose the Right Wedding Music for Every Moment

- Step by Step Guide to Crafting Personalized Wedding Themes

- How to Plan a Sustainable Wedding with Eco Friendly Ideas