Affordable Wedding Budget Planning for Stress Free Celebrations

Defining Your Dream Wedding Within Your Budget

Understanding Your Financial Situation

Before diving into the enchanting world of wedding planning, it's crucial to have a clear understanding of your financial situation. This involves not only considering your current income and savings but also any outstanding debts or financial commitments. A realistic assessment of your available funds will help you set a wedding budget that is both achievable and enjoyable. Thorough financial planning is essential to avoid any unnecessary stress or financial strain down the road. This step also allows you to identify potential financial support from family or friends, which can be a significant aid in achieving your dream wedding without exceeding your budget. It's important to be honest with yourselves about your financial capacity and to avoid unrealistic expectations.

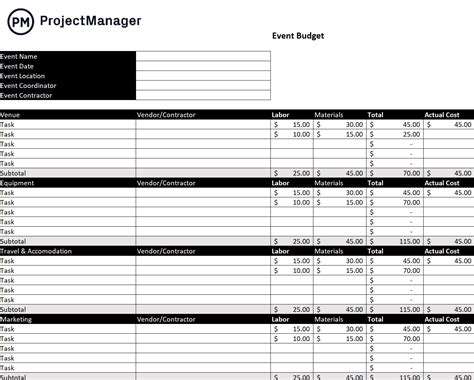

Detailed budgeting involves creating a comprehensive list of all anticipated expenses. This includes not only the obvious costs like venue rental, catering, and photography but also less apparent costs like invitations, decorations, and transportation. Accurately estimating these expenses will provide a clear picture of the total cost and help you identify areas where you can potentially save money without compromising on the overall experience you desire. It's essential to be realistic about your needs and desires for the wedding and to prioritize items that have the most sentimental value or create the most memorable moments for you and your guests.

Setting Realistic Budget Goals

Once you've established your financial situation, it's time to set realistic budget goals. This involves prioritizing your wedding elements and determining how much you're willing to spend on each aspect. For example, you might decide to spend a significant portion of your budget on the venue and catering, but opt for a more budget-friendly approach to the decorations. A well-defined budget allows you to make informed decisions about every aspect of your wedding, ensuring that you're not sacrificing your financial well-being for an event that should be celebrated and cherished.

Consider creating a detailed breakdown of your budget, allocating specific amounts to different categories. This will help you stay on track and avoid overspending in certain areas. For example, you might allocate 30% of your budget to the venue, 25% to catering, 15% to photography, and 10% to decorations. Flexible budgeting allows for adjustments as you move through the planning process, which is crucial for unexpected costs or changes in your priorities.

Be open to negotiating prices with vendors. Many vendors are willing to work with couples to find a solution that fits their budget. Don't be afraid to ask for discounts or alternative packages that might help you save money without sacrificing the quality of the services you receive. Remember to factor in potential changes in costs. Prices can fluctuate based on the time of year, demand, and other market factors. Flexibility and proactive communication with vendors will help you navigate these fluctuations and stay within your budget.

Finding Affordable Alternatives and Creative Solutions

A key element of budget-friendly wedding planning is exploring affordable alternatives and creative solutions. Instead of choosing the most expensive venue, consider a unique setting like a park, a vineyard, or a community center. This can dramatically reduce costs while allowing for a beautiful and memorable experience. Creative solutions for decorations can significantly reduce costs without compromising style. DIY projects, using locally sourced flowers, or renting unique pieces can all contribute to a beautiful and memorable wedding within your budget.

Consider alternative wedding elements that can reduce costs without sacrificing your dream wedding. For example, you could opt for a smaller guest list, a more casual attire request, or a shorter ceremony. These choices can significantly reduce costs associated with catering, venue rental, and other expenses. Creative alternatives to traditional wedding elements can add a unique touch to your special day. For instance, consider a themed reception, a personalized playlist, or a heartfelt toast instead of a traditional speech.

Strategic Venue and Vendor Choices

Venue Selection Criteria

Choosing the right venue is paramount to a successful event. Careful consideration must be given to factors such as the venue's capacity, amenities, and overall ambiance. A venue that aligns with the event's theme and target audience is crucial for creating a positive experience for attendees. This includes evaluating the accessibility features, catering options, and potential for customization to create a unique and memorable atmosphere. A venue with a strong reputation for event management and a proven track record of smooth operations is also a significant factor.

Beyond the immediate physical space, the location's accessibility and proximity to transportation hubs, hotels, and other amenities must be assessed. This logistical aspect can significantly impact attendee convenience and reduce stress on event organizers. The venue's reputation for safety and security should also be a top priority.

Vendor Partnerships for Success

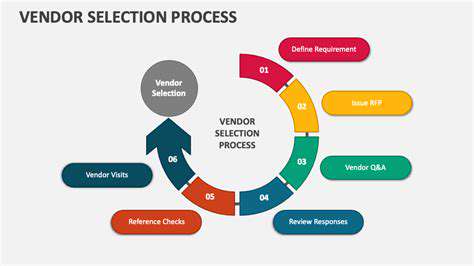

Partnering with the right vendors is essential for delivering high-quality services and a seamless event experience. This includes selecting caterers, entertainment providers, and any other relevant suppliers. Careful vetting of potential vendors is necessary to ensure they possess the necessary expertise, experience, and resources to meet the event's specific requirements. This includes reviewing their portfolios, testimonials, and references to gain a comprehensive understanding of their capabilities and reliability. Careful consideration should be given to the vendor's pricing structure and ability to adapt to any last-minute changes or modifications.

A thorough understanding of vendor contracts is also vital. This ensures that all obligations and responsibilities are clearly defined. Understanding the terms and conditions of contracts can help to avoid potential disputes and misunderstandings. Moreover, securing multiple vendor options, where possible, provides flexibility and negotiation power during the event planning process. This is a crucial factor in managing budgets and ensuring value for money.

Budgeting and Cost Considerations

Developing a detailed budget is crucial for effective event planning. This budget should meticulously outline all anticipated expenses, from venue rental fees and vendor costs to marketing and promotional materials. Careful allocation of funds is essential to ensure that all necessary elements are adequately funded. Accurately assessing and forecasting costs associated with potential unforeseen circumstances, such as unexpected weather or equipment failures, is critical for maintaining financial stability throughout the event planning process. A well-defined budget allows for adjustments and contingency planning if necessary.

Careful consideration of the return on investment (ROI) for each expense is essential. Understanding how each component contributes to the overall success of the event is critical to optimize decision-making. By analyzing the potential value of each investment, event organizers can ensure that resources are allocated effectively and efficiently to maximize the impact of the event.

Managing Your Finances for a Smooth Wedding Journey

Budgeting Basics

Creating a budget is the cornerstone of effective financial management. It's not just about tracking expenses; it's about understanding where your money goes and proactively planning for your financial goals. A well-structured budget helps you identify areas where you can cut back and allocate funds efficiently towards savings and investments. A budget empowers you to take control of your finances and avoid unnecessary debt. This proactive approach fosters a sense of financial security and allows you to make informed decisions about your spending.

Understanding your income and expenses is crucial for creating a realistic and effective budget. Categorize your income sources and meticulously track all your expenses, from rent and utilities to groceries and entertainment. Use budgeting apps or spreadsheets to visualize your spending patterns and make necessary adjustments to ensure your budget aligns with your financial goals.

Saving Strategies

Saving money is essential for achieving long-term financial stability. Develop a disciplined savings plan that considers both short-term and long-term goals. Start with small, achievable savings goals and gradually increase the amount as your financial situation improves. Regular contributions, even small ones, add up significantly over time. This helps build a financial cushion for emergencies and future investments.

Consider setting up automatic transfers to a savings account to make saving a habit. This automatic system ensures consistent savings, eliminating the temptation to spend the money elsewhere. Explore various savings options, such as high-yield savings accounts or certificates of deposit (CDs), to maximize your returns.

Debt Management

Managing debt effectively is crucial for maintaining financial well-being. Prioritize high-interest debt and develop a plan to pay it off systematically. Explore debt consolidation options if necessary. Understanding the terms of your loans will help you develop a repayment schedule that works for your budget.

Consider seeking professional financial advice if you're struggling with significant debt. A financial advisor can offer personalized strategies to tackle your debt and guide you toward a sustainable financial future.

Investing for the Future

Investing your money can significantly boost your long-term financial security. Research different investment options, such as stocks, bonds, and mutual funds, to find ones that align with your risk tolerance and financial goals. Diversification is key to mitigate potential risks and maximize returns. Start early, and the power of compounding will work wonders for your investments.

Tracking Your Progress

Regularly review your financial progress to ensure you're on track towards your goals. Use budgeting apps or spreadsheets to monitor your income, expenses, and savings. Identify areas where you can improve and adjust your strategies accordingly. Celebrate your successes and stay motivated to achieve your financial objectives.

Emergency Fund Building

Building an emergency fund is a vital component of financial preparedness. Aim to save three to six months' worth of living expenses in a readily accessible account. This financial safety net provides protection against unexpected events like job loss, medical emergencies, or car repairs. Having an emergency fund instills confidence and provides peace of mind.

Seeking Professional Guidance

Don't hesitate to seek professional financial advice when needed. A qualified financial advisor can provide personalized guidance, assess your financial situation, and develop a tailored plan to achieve your goals. They can offer expertise in various financial instruments and investment strategies. Seeking professional guidance can empower you to make informed decisions and stay on track towards your financial aspirations.

Read more about Affordable Wedding Budget Planning for Stress Free Celebrations

Hot Recommendations

- Step by Step Guide to Creating a Memorable Wedding Experience

- Expert Advice on Planning a Wedding with Family Traditions

- How to Organize a Destination Wedding That Reflects Your Style

- How to Choose the Perfect Wedding Venue for Your Style

- Expert Tips for Choosing Wedding Decor That Elevates Your Event

- How to Plan a Timeless Wedding with Modern Flair

- How to Create a Detailed Wedding Plan That Covers Every Detail

- How to Choose the Right Wedding Music for Every Moment

- Step by Step Guide to Crafting Personalized Wedding Themes

- How to Plan a Sustainable Wedding with Eco Friendly Ideas