How to Create a Realistic Wedding Budget Without Stress

List of Contents

Assess monthly income, savings, and expenses for wedding planning.

Set a realistic wedding budget, ideally 30% of annual income.

Identify fixed and variable costs for better budgeting.

List all expected wedding expenses to avoid surprises.

Establish a total budget cap based on financial situation.

Prioritize essential wedding elements over optional ones.

Use budgeting tools to streamline financial planning.

Monitor and adjust budget regularly to stay on track.

Include a contingency fund for unexpected wedding costs.

Assess vendor prices to make informed financial decisions.

Stay flexible and adapt your budget as needed.

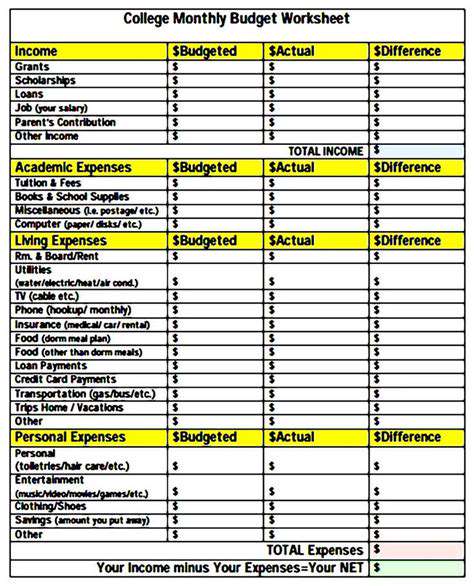

Assess Your Financial Situation

Analyze Your Income Sources

Start by thoroughly examining your monthly cash flow. This means accounting for every dollar coming in - not just paychecks but also freelance work, rental properties, or stock dividends. Having this complete financial snapshot helps you gauge exactly how much you can comfortably allocate to wedding preparations without straining other obligations.

If you've already been setting money aside specifically for the wedding, factor that into your calculations. For those starting from scratch, look for painless ways to build savings - maybe skipping two takeout coffees weekly adds up faster than you'd think!

Review Existing Expenses

Create two distinct lists: one for fixed monthly bills (rent, car payments) and another for flexible spending (hobbies, dining out). Seeing these numbers side-by-side often reveals surprising opportunities to redirect funds toward your Wedding Budget without major lifestyle sacrifices.

Pay special attention to recurring subscriptions - that $15/month streaming service you barely use could cover half your wedding favors. Recent consumer surveys show most people underestimate discretionary spending by nearly 40%, so approach this audit with brutal honesty.

Determine Your Wedding Budget Goal

While the 30% of annual income guideline works for many, your specific circumstances might demand adjustments. If you're carrying student loans or saving for a home, consider scaling back to 20-25%. Always leave breathing room - unexpected costs pop up like weeds. That beautiful outdoor venue? Better budget extra for tent rentals in case of rain.

Remember to account for post-wedding life too. Blowing your entire savings on one day might lead to financial headaches down the road. Balance is key.

Evaluate Potential Financial Support

Have frank but respectful conversations with family about contributions. Some parents start saving when their kids are toddlers, while others expect complete financial independence. If borrowing becomes necessary, credit unions often offer better personal loan rates than traditional banks. Just ensure repayment terms align with your post-nuptial income projections.

Determine Your Priorities

Understanding Your Needs and Values

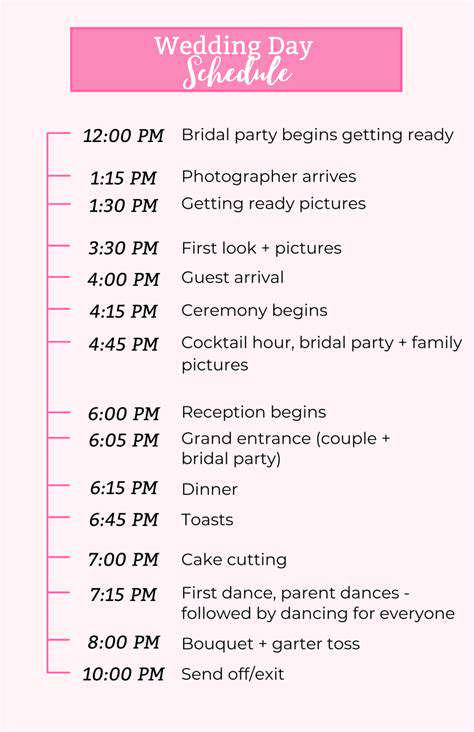

Sit down with your partner and complete this sentence: Our wedding wouldn't feel complete without... Maybe it's live music that gets grandma dancing, or farm-to-table catering that reflects your sustainability values. Venues often consume the biggest chunk (30-40%), so choose spaces that naturally align with your vision to avoid costly transformations.

Setting a Realistic Budget Framework

Break down that big scary number into digestible pieces. Allocate funds like you're planning a vacation - certain elements deserve splurging while others work fine at economy level. Pro tip: Book non-Saturday dates at popular venues for instant 15-20% savings. Always keep a 10% buffer for those but the photos would look better with upgraded linens moments.

Create a Detailed Budget Breakdown

Understand Fixed vs. Variable Costs

Lock in non-negotiable expenses first: venues with strict cancellation policies, must-have photographers. Leave flexibility in areas like floral arrangements where DIY options or seasonal blooms can slash costs.

Create a Comprehensive List of Expected Expenses

Use this categorized checklist:

- Venue (including cleanup fees!)

- Attire (alterations cost more than you think)

- Food & Drink (don't forget cake cutting fees)

- Entertainment (including sound system rentals)

Establish a Total Budget Cap

Base your ceiling on actual savings and confirmed contributions - not optimistic assumptions. If Aunt Sue might help but hasn't confirmed, plan without that money. Remember, 72% of couples exceed their initial budgets according to recent surveys.

Utilize Budgeting Tools and Templates

Try the envelope method digitally - apps like Goodbudget let you allocate virtual envelopes for each wedding category. When the floral envelope empties, stop browsing peony arrangements!

Research and Compare Costs

Assessing Vendor Prices

Always ask vendors for detailed breakdowns. That $5,000 photography package? Maybe $1,200 is for albums you could order later. Negotiate à la carte options - many vendors offer custom packages.

Utilizing Budgeting Tools

Create a shared spreadsheet with real-time updates. Include columns for estimated vs. actual costs, payment deadlines, and deposit amounts. Color-code cells to instantly spot areas trending over budget.

Stay Flexible and Adjust as Needed

Recognize When to Adapt Your Budget

Treat your budget like a living document. If you splurge on designer shoes, balance it by simplifying centerpieces. Maybe swap imported flowers for local blooms, or reduce cocktail hour passed appetizers from eight varieties to five.

Create a Contingency Plan

That 10% buffer isn't for nice-to-haves - it's insurance against true emergencies like sudden vendor closures. Store contingency funds separately from main accounts to avoid accidental spending. Consider high-yield savings accounts to grow this safety net passively.

Read more about How to Create a Realistic Wedding Budget Without Stress

Hot Recommendations

- How to Choose the Right Wedding Photographer for Your Big Day

- Step by Step Guide to Wedding Venue Decoration

- Expert Advice on Choosing the Right Wedding Venue

- Creative Vintage Wedding Themes for a Retro Celebration

- Inspiring Beach Wedding Ideas for a Unique Celebration

- Affordable Wedding Venue Ideas for Every Style and Budget

- Step by Step Wedding Planner Checklist for Every Bride and Groom

- How to Plan a Timeless Wedding with Detailed Budgeting Strategies

- Ultimate Wedding Venue Selection Guide for Couples

- Essential Wedding Planning Tips for First Time Brides