Step by Step Guide to Creating a Wedding Budget Plan

Creating a Realistic Wedding Budget: Allocation and Prioritization

Understanding Your Financial Situation

Before diving into the specifics of wedding budget allocation, it's crucial to honestly assess your current financial situation. This includes evaluating your income, existing debts, and any potential financial commitments, like student loans or car payments. Understanding your available resources is paramount to setting realistic expectations for your wedding budget and avoiding potential financial strain down the line. This self-assessment should also consider any savings or investments you already have, as these can significantly impact your overall budget planning.

Detailed financial records, including bank statements and credit card statements, are essential. Reviewing these documents will help you identify your monthly income and expenses. Categorize your expenses to understand where your money is currently going. This will give you a clearer picture of your financial capacity and help you to prioritize spending within the wedding budget.

Allocating Funds for Essential Wedding Expenses

Once you've established a clear understanding of your finances, you can begin allocating funds for the core elements of your wedding. This includes the venue, catering, and the wedding ceremony and reception. It's crucial to establish a realistic budget for each of these elements, considering the different options available. Research and compare prices from various vendors to get a sense of the market rates and negotiate where possible. For instance, considering a smaller venue, or a less-elaborate menu, might significantly reduce costs.

Don't overlook crucial items like invitations, stationery, and photographer/videographer fees. These may seem like smaller components, but they can quickly add up. Establishing a clear budget for each of these essential components will help in avoiding budget surprises. Prioritize the elements that hold the most significance to you, as you want to create a special day that reflects your vision, while staying within your financial limitations.

Prioritizing and Negotiating Wedding Costs

After allocating funds for the essential wedding expenses, it's time to prioritize and negotiate costs. This step involves evaluating each expense category and deciding which elements are non-negotiable and which ones can be adjusted or omitted altogether to meet your budget. For example, if your budget is tight, you might consider a more affordable venue, or a smaller guest list. Negotiating with vendors is another crucial aspect of this stage. A polite and proactive approach can often lead to significant discounts or value-added services.

Contingency Planning and Budget Flexibility

Finally, it's essential to incorporate contingency planning into your wedding budget. Unforeseen circumstances can arise, such as unexpected weather changes or last-minute adjustments to your plans. Setting aside a small contingency fund for these unexpected expenses can prevent financial strain during the wedding planning process. This contingency fund should be a dedicated portion of your wedding budget. It's also important to maintain a degree of flexibility within your overall budget plan. This means being open to adjustments and modifications as needed to ensure that you stay within your financial constraints without compromising the quality of your wedding day.

Managing Your Wedding Finances: Tracking and Monitoring Expenditures

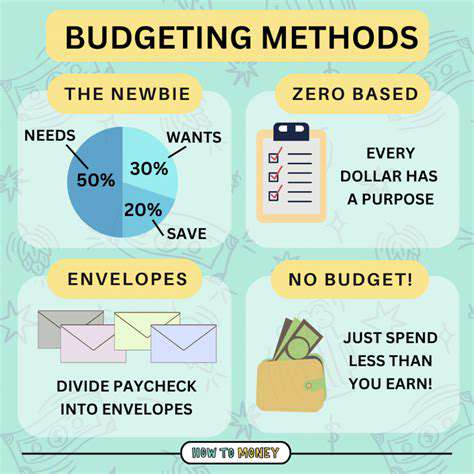

Budgeting for the Big Day

Creating a comprehensive wedding budget is crucial for avoiding financial stress during the planning process and ensuring your special day doesn't derail your future financial goals. This involves meticulously listing all anticipated expenses, from venue rental and catering to invitations and decorations. Thorough research and comparison shopping are vital to finding the best deals and staying within your allocated budget.

It's essential to consider not only the immediate costs but also potential extras, like transportation for guests or a photographer's package. Don't forget about contingencies for unexpected expenses; having a small cushion in your budget can provide peace of mind during the planning stages.

Vendor Selection and Negotiation

Choosing the right vendors is paramount to a successful wedding. Thorough research and careful consideration of your needs and preferences are key to finding the perfect match. Look for vendors who not only offer excellent services but also align with your vision for the event. Don't hesitate to negotiate prices to secure the best possible value for your money.

Consider getting multiple quotes from different vendors to compare services and pricing. This allows you to make an informed decision based on quality, cost, and overall experience.

Guest List and Invitations

Your guest list significantly impacts your wedding budget. Carefully consider your relationship with each potential guest and whether their presence aligns with your vision for the event. A well-defined guest list helps you effectively manage your budget for catering, venue capacity, and other essential resources.

Saving Strategies and Financial Planning

Saving for your wedding can be effectively managed through a dedicated savings account. This will allow you to track your progress and stay motivated throughout the planning process. Consider setting realistic savings goals and establishing a timeline for achieving them. It's also beneficial to explore potential financial assistance from family or friends.

Payment and Timeline Management

Managing payments to vendors on a timely basis is critical to maintaining a smooth flow of your wedding planning. Having a clear payment schedule and communicating it to all vendors can prevent issues and maintain positive relationships. This can also help you keep track of outstanding balances and ensure that no payments are missed.

Contingency Planning and Financial Backup

Unforeseen circumstances can arise during wedding planning. Establishing a contingency fund is a proactive approach to address unexpected costs or changes in plans. This could be anything from a change in venue to unexpected weather. Having a backup plan or financial cushion ensures that your wedding day remains a positive experience, regardless of potential setbacks.

Contingency Planning and Budgeting for Unforeseen Costs

Understanding the Importance of Contingency Planning

Contingency planning is crucial for any organization, large or small. It's a proactive approach to anticipating and mitigating potential disruptions, whether they arise from natural disasters, economic downturns, supply chain issues, or unexpected operational hiccups. By developing detailed plans for various scenarios, businesses can maintain stability and minimize negative impacts on their operations, finances, and reputation.

Identifying Potential Risks and Threats

The first step in effective contingency planning is thorough risk assessment. This involves identifying potential threats and vulnerabilities that could affect your organization. This could include analyzing historical data, conducting industry research, and consulting with experts. A comprehensive risk register should include a description of each risk, its potential impact, likelihood of occurrence, and existing mitigation strategies.

Consider factors such as natural disasters, economic fluctuations, cybersecurity breaches, and even internal issues like employee turnover or equipment malfunctions. Each risk should be evaluated based on its potential severity and frequency.

Developing Contingency Plans

Once potential risks are identified, the next step is developing specific contingency plans. Each plan should outline the steps to be taken in response to a particular threat. These plans should be detailed, realistic, and easily understandable by all relevant personnel.

Allocating Resources for Contingency Funds

Contingency planning isn't just about creating plans; it's about ensuring the resources are available to implement them. This often necessitates allocating a portion of your budget to a contingency fund. The size of this fund should be based on a thorough analysis of potential costs associated with various scenarios. Consider factors such as repair costs, replacement expenses, and potential lost revenue.

Budgeting for Unforeseen Costs

A key component of contingency planning is budgeting for unforeseen costs. This involves estimating the potential financial impact of different risks and setting aside funds to cover these expenses. Don't just think about the immediate costs, consider the potential long-term effects. For example, a cyberattack might require not only immediate repair costs but also ongoing security enhancements.

Implementing and Regularly Testing Contingency Plans

Developing contingency plans is only the first step. They must be implemented and regularly tested to ensure they remain effective. Regular drills and simulations can help identify weaknesses and gaps in your plans and allow for necessary adjustments. This helps ensure that your team is prepared and your processes are streamlined in case of an actual event.

Reviewing and Updating Contingency Plans

Contingency plans are not static documents. They should be reviewed and updated periodically to reflect changing circumstances, evolving risks, and new technologies. Regular reviews are essential to ensure the plans remain relevant and effective in addressing contemporary challenges. This ongoing process is critical for maintaining a strong and resilient organization.

Read more about Step by Step Guide to Creating a Wedding Budget Plan

Hot Recommendations

- Step by Step Guide to Creating a Memorable Wedding Experience

- Expert Advice on Planning a Wedding with Family Traditions

- How to Organize a Destination Wedding That Reflects Your Style

- How to Choose the Perfect Wedding Venue for Your Style

- Expert Tips for Choosing Wedding Decor That Elevates Your Event

- How to Plan a Timeless Wedding with Modern Flair

- How to Create a Detailed Wedding Plan That Covers Every Detail

- How to Choose the Right Wedding Music for Every Moment

- Step by Step Guide to Crafting Personalized Wedding Themes

- How to Plan a Sustainable Wedding with Eco Friendly Ideas